- As a leader in sea logistics, Kuehne+Nagel closely tracks and collects data on the movement of vessels, including actual arrivals and vessel delays.

- A summary of this analysis, based on neutral data, is published monthly in our Schedule Reliability Report, available on Sea News.

Executive Summary

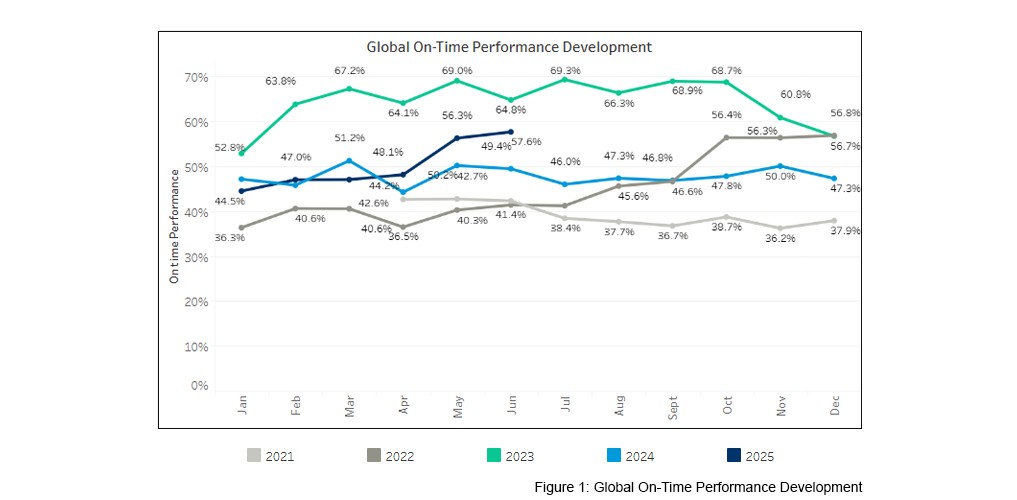

Global schedule reliability rose to 57.6% in June, reflecting a 1.3 percentage point increase from May and an 8.2 percentage point improvement year-on-year.

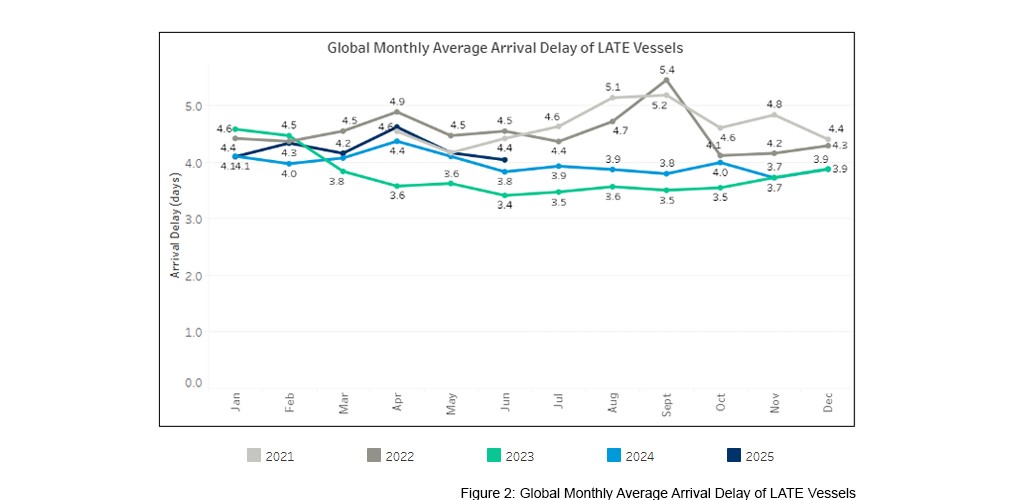

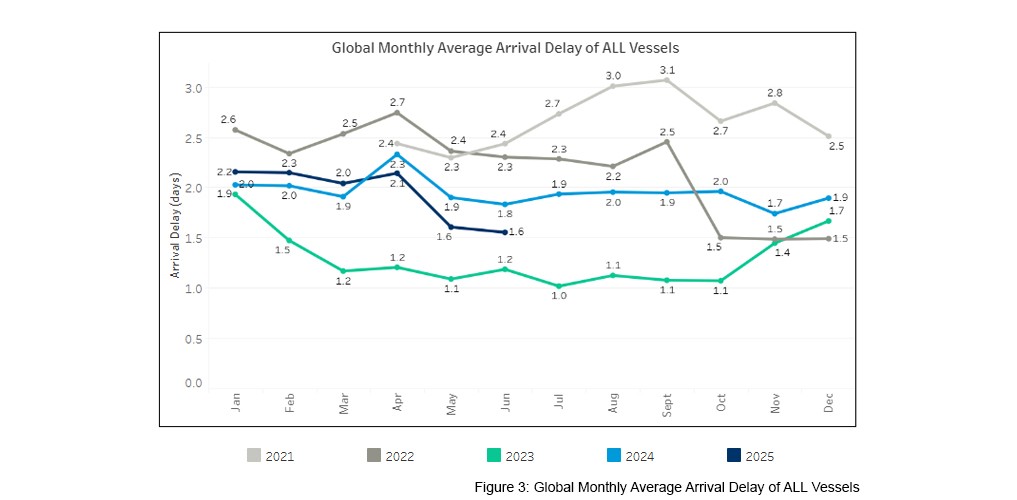

The average arrival delay for LATE vessels dropped to 4.0 days, while the overall average delay across ALL vessels remained stable at 1.6 days.

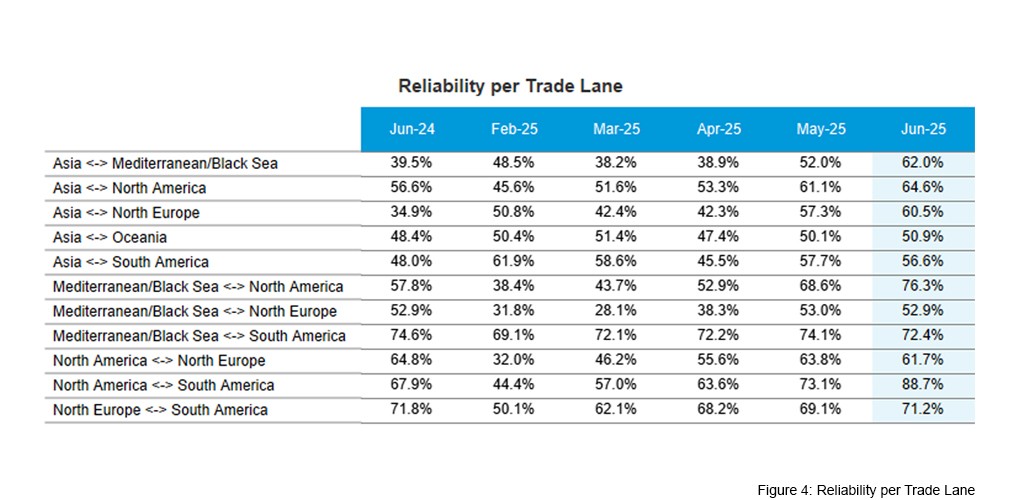

Among the 11 major trades, seven recorded improvements, while four experienced slight declines. For several routes, June marked the best performance of the year so far.

The North America↔South America trade lane stood out with the sharpest increase, climbing to 88.7%, the highest performance for this trade since the start of this report.

Additionally, seven of the 11 trades saw year-on-year improvements.

Blank sailing data (weeks 23-26) recorded seven void sailings on Asia→North Europe, accounting for 8.7% of total capacity.

On Asia→North America, carriers announced 16 blanked sailings, accounting for 6.5% of total capacity, with 4 to the East Coast and 12 to the West Coast.

The Transatlantic westbound route recorded three blank sailings to the US East Coast (3% of capacity), and none to the West Coast.

Global On-Time Performance

In June, global on-time performance rose marginally to 57.6%, the highest level since December 2023.

As shown in Figure 1, the upward trend in global reliability, which began in February, continues.

A year-on-year comparison reveals an 8.2 percentage point difference.

Last month, LATE vessels arrived an average of 4.0 days behind schedule, an improvement of 0.2 days from the previous month.

In June 2025, vessels arrived 0.2 days later than in the same month last year.

The average arrival delay for ALL vessels saw no change last month, at 1.6 days.

A year-on-year comparison shows that vessels arrived 0.2 days earlier than in June 2024.

Reliability per Trade Lane

Trade performance across the 11 major trades ranged from 50.9% to 88.7% in June.

Seven trades posted month-on-month improvements, while four trades experienced slight declines.

North America↔South America recorded the strongest gain, rising by 15.6 percentage points to reach 88.7% reliability – the only trade to surpass the 80% threshold.

Meanwhile, Asia↔Mediterranean/Black Sea, one of the trades most affected by the Red Sea situation, achieved a 10 percentage point increase, pushing its reliability above 60%.

Similarly, Asia↔North Europe exceeded 60% reliability in June, gaining 3.2 percentage points compared to the previous month.

In contrast, North America↔North Europe saw the largest decline, dropping by 2.1 percentage points, though it remained within the 60% range.

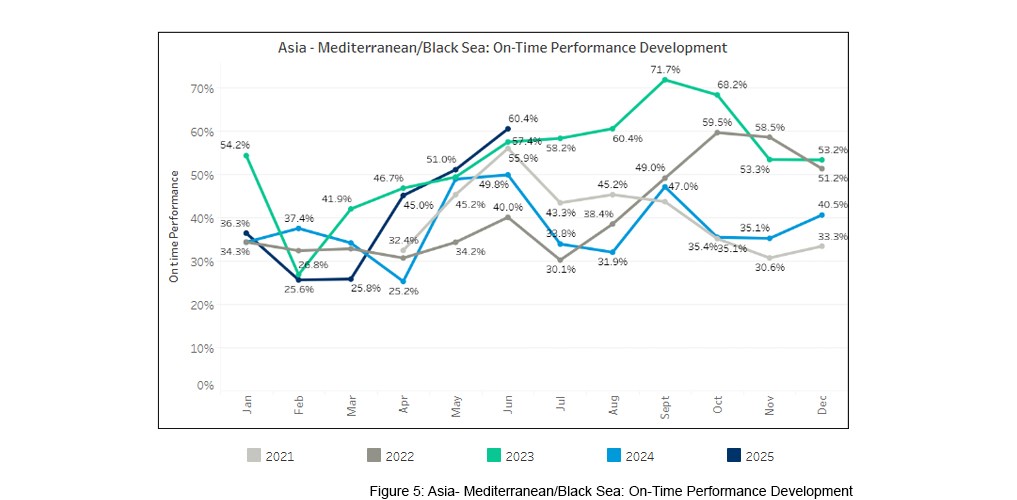

Reliability on Reliability on Asia ↔ Mediterranean/Black Sea

Westbound

A closer look at Asia→Mediterranean/Black Sea shows steady improvement over the past three months.

In June, reliability rose to 60.4%, a 9.4 percentage point increase from May and a 10.6 percentage point gain year on year.

Such levels were last recorded in December 2023.

LATE vessels sailing in this direction averaged 4.3 days behind schedule, while the overall average delay across ALL vessels was 1.3 days.

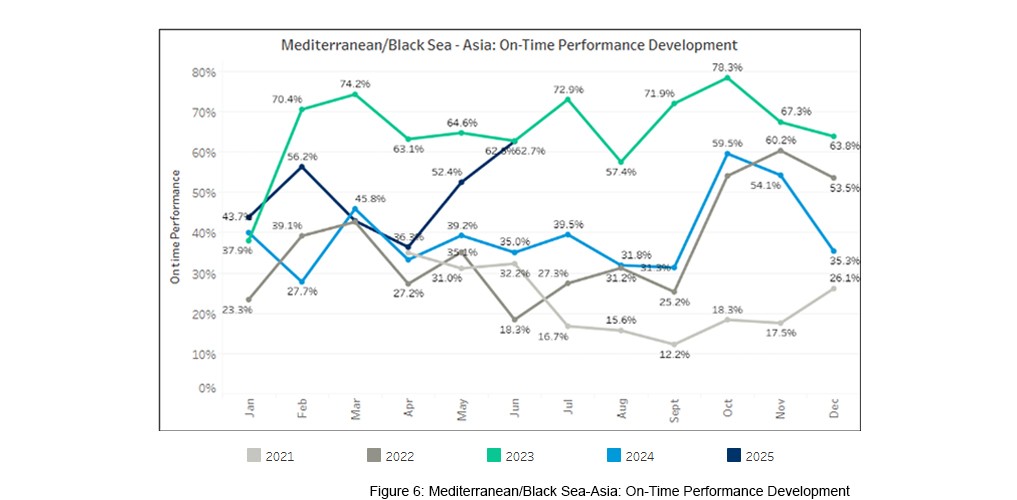

Eastbound

On the backhaul, reliability rose to 62.5% in June, a 10.1 percentage point improvement compared to May.

As shown below, June 2025's performance is in line with June 2023's and the highest recorded for this year so far.

Additionally, average delays dropped to 4.9 days for LATE vessels and 1.7 days across ALL vessels.

Methodology

Calculating the on-time performance

To calculate the on-time performance of a service, Kuehne+Nagel uses vessel schedules from carrier(s) offering that service. Only carrier schedules that match our quality criteria are used for the schedule reliability calculation.

As carriers update schedules constantly, they become more accurate the closer vessels get to a destination port. For this reason, we have implemented a "schedule freeze period" of 14 days prior to actual vessel arrival. In other words, we benchmark the actual arrival with what carriers last announced 14 days earlier. To identify the actual time of arrival, Kuehne+Nagel consumes AIS (Automatic Identification System) vessel data. All vessels which arrive within a +/- 24-hour window at the port of destination compared to the last announced arrival are considered to be on time. Port call omissions and blank sailings announced after the 14-day freeze are excluded from the calculation.

Assigning carrier services to multiple trade lanes

Many services operate on various trade lanes (e.g. a carrier service between Asia and North Europe also calls ports in the Middle East and or the Mediterranean), and therefore carrier services may be listed in multiple trade lanes.

Definition of trade lanes

There is no common standard for the definition of trade lanes. This means, depending on the source, you will find different trade lanes as well as different regions, countries and ports assigned to a trade lane. Kuehne+Nagel has defined its own way of mapping and has assigned ports to these trade lanes accordingly. On-time performances of vessels are captured in our reports on defined main trades, meaning trades moving large container volumes on vessels. Therefore, niche trades and services within one trade, called "Intra Trade" services (e.g. Intra-Asia, Intra-Europe), are currently out of scope.

A PDF version of this report can be found here

Stay ahead with the latest updates! Subscribe to our SeaNews newsletter for the most relevant information.